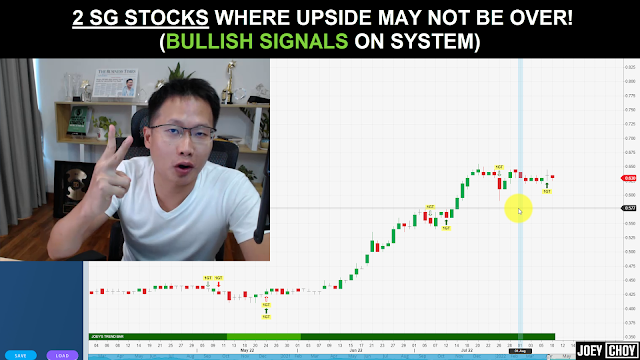

With oil prices stabilizing and rebounding, we have started to see strength in some Singapore oil and gas counters.. 🛢⛽

However, not all of them are good. Most are still seeing weakness with sellers coming back. 😢

𝐒𝐨 𝐰𝐡𝐢𝐜𝐡 𝐚𝐫𝐞 𝐭𝐡𝐞 𝟑 𝐬𝐭𝐫𝐨𝐧𝐠𝐞𝐬𝐭 𝐫𝐢𝐠𝐡𝐭 𝐧𝐨𝐰 𝐭𝐡𝐚𝐭 𝐰𝐞 𝐬𝐡𝐨𝐮𝐥𝐝 𝐛𝐞 𝐟𝐨𝐜𝐮𝐬𝐢𝐧𝐠 𝐨𝐧 𝐚𝐧𝐝 𝐰𝐡𝐞𝐫𝐞 𝐜𝐚𝐧 𝐭𝐡𝐞𝐲 𝐩𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥𝐥𝐲 𝐡𝐞𝐚𝐝 𝐭𝐨?

Joey here, Top Tier Remisier and trader in Phillip Securities.

Join me as I reveal to you 3 top Singapore Oil and gas plays that has been in my watchlist over the past few months. 😎👍

After the recent sell down, we have seen some 𝐍𝐄𝐖 𝐛𝐮𝐥𝐥𝐢𝐬𝐡 𝐬𝐢𝐠𝐧𝐚𝐥𝐬 𝐫𝐞𝐭𝐮𝐫𝐧𝐢𝐧𝐠..

Discover where we can potentially head to as long as we hold above certain key levels.

Watch here >> https://youtu.be/RKOf1T8cRxU