Wednesday, April 30, 2014

****************** CapitaRetail China Trust: Rebound possible on temp retracement...... Now at 1.475.

Following up from previous BUY CALL: http://singaporetradinginsights.blogspot.sg/2014/04/capitaretail-china-trust-broken-out-of.html

CapitaRetail China Trust has traded to a high of 1.52 before some profit taking on market weakness… it has since over the past few days traded down to the 1.45 support level…. As long as 1.45 remains as support, we are bullish with upside to 1.52, 1.55 then 1.60. Could be an opportunity to accumulate on a bargain at the moment, not for contra, have to hold to ride any rebound above 1.52.

Stop loss 1.435

Tuesday, April 29, 2014

**************Artivision: Positive call triggered ! .... Now at 0.052 ! WHAT A huge surge ?

Artivision may still be good to go after breaking above 0.050 psychological resistance further on Top 3 volume.Clients were alerted earlier when sellers will still left at 0.047, since then, they were grabbed rapidly till it crossed above 0.050....

Be our client now to RECEIVE LIVE EMAIL / SMS on Top trading calls, don’t settle for Delayed notification on this BLOG.

Email to enquiry@firstratebrokers.com NOW ! OR Click here to Open a Free Trading account ! J

REPOST ****************** Figtree: Short term upside on breakout above 0.385 resistance.... TOP 30 Volume seen currently.... 0.39 now! (REPOST, NOW AT 0.405)

Now at 0.405, may still be good to go if it manages to stay above 0.400 support.

Sent: Monday, April 28, 2014 2:02 PM

Subject: ************************* Figtree: Short term upside on breakout above 0.385 resistance.... TOP 30 Volume seen currently.... 0.39 now!

Subject: ************************* Figtree: Short term upside on breakout above 0.385 resistance.... TOP 30 Volume seen currently.... 0.39 now!

Entry: 0.385 to 0.395

Target to 0.45 then 0.48

Stop loss 0.37

************Vard: Support broken.... more downside likely.... at 0.975..... (CFD SELL) ( REPOST - NOW AT 0.945)

Bearish setup for Vard on support breakdown…. Email and SMS was sent to clients LIVE EARLIER when triggered….

REPOST ******************* Sheng Siong: a break above consolidation phase finally.... Poised for more upticks............ (BUY - Price 0.63)

From yesterday call. Can still consider for longer term holding yield and capital upside.

Sent: Monday, April 28, 2014 5:15 PM

Subject: ******************** Sheng Siong: a break above consolidation phase finally.... Poised for more upticks............ (BUY - Price 0.63)

Subject: ******************** Sheng Siong: a break above consolidation phase finally.... Poised for more upticks............ (BUY - Price 0.63)

Sheng Siong has broke above the 0.600 downtrend channel resistance line last Friday. Today it has again tested the 0.625 horizontal resistance formed since Nov last year, and managed to cross above it. More upward momentum like to take it higher to 0.65 then 0.700 in the coming weeks. Slow and defensive counter to have which is good to have in your portfolio for yield also. Note that at this level it has also JUST BROKEN ABOVE the 200 day MA LINE, after breaking below in Oct last year. This could signal a trend reversal finally. JP Morgan has an Overweight call on it.

Stop loss 0.59

Monday, April 28, 2014

******************* Singpost: Follow UP, Breakout really did occur TODAY...... Emailed to CLIENTS before breakout LAST FRIDAY!

Clients will alerted to Singpost by Email last Friday afternoon before the breakout above 1.40 seen today……. Have you received the email ?

This Blog highlights "ONLY" some of the calls that our Clients received and "ONLY" after OUR Clients have received it. Be our client now to RECEIVE “ALL” Technical Trading calls "LIVE", TOP Fundamental research in your INBOX now plus “LIVE SMS”, plus many more value added service. Don’t miss out ! Some have already locked in profits today……..

******************** Frasers Centre Point Trust: Upward trend in place..... Supported above 1.79 currently....... Now at 1.795!

Frasers Center Point Trust has broke above the Critical 1.80 resistance last week trading to a high of 1.84 before dipping back down again today due to EX DIV date……

At this level still support above the Long term 200 day MA line so may still continue to trade upwards eventually. Can accumulate on dips above 1.79. Target to 1.84, then 1.88 then 1.95. Has been forming higher lows since Feb this year on strength… Can be a yield play to hold for the longer term for capital upside and dividend yield above 5%.

Stop loss wide at 1.765

*********************** Kingwan: A potential breakout play....... May consolidate from 0.325 to 0.35 before further uptick...... (FOLLOW UP - NOW AT 0.34)

Following up from previous BUY call: http://singaporetradinginsights.blogspot.sg/2014/04/kingwan-potential-breakout-play-may.html

Kingwan has consolidated for about a week from 0.33 to 0.34. Potential upside breakout still possible for resistance at 0.35. Be prepared for this, target to 0.400 first on break!

Raise stop loss to 0.325

Friday, April 25, 2014

************** CapitaRetail China Trust: Broken out of consolidation phase 2 days ago, more upside again on temp pull back.... (REPOST TO BLOG)

Sent: Wednesday, April 23, 2014 11:02 AM

Subject: **************** CapitaRetail China Trust: Broken out of consolidation phase 2 days ago, more upside again on temp pull back....

Subject: **************** CapitaRetail China Trust: Broken out of consolidation phase 2 days ago, more upside again on temp pull back....

CapitaRetail China Trust has broken out of the 1.42 resistance level which it has traded below for about 8 months. Likely to consolidate from 1.42 to 1.46 before more upside. Can accumulate on dips above the 1.40 and 1.42 level, bullish in the midterm as long as these supports hold out. May have to hold to ride any upside and not for contra. Target to 1.55 then 1.65.

Stop loss at 1.385

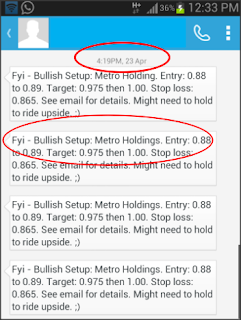

****************** Metro Holding: Positive call triggered ! Currently at 0.935 ! Have you RECEIVE our LIVE SMS triggered before breakout?

Posted to clients LIVE by Email and SMS on Wednesday. May still be good to go as per target price mentioned even though some clients have already taken profit. 0.935 CLEARING.

If you do not want to miss out anymore - Click here to Open a Free Trading account ! J

***************** Hong Fok: Surging to a new high on strength.... now at 0.815.... May head to 0.900 near term..... (REPOST TO BLOG: now at 0.835)

Following up from email to clients on Tuesday, Hong Fok may still be good to go after consolidating from 0.82 to 0.84. A break above 0.845 would see some strenght back again.

DON’T settle for delayed notification, RECEIVE LIVE trading calls through SMS AND Email now –

Thursday, April 24, 2014

***************** Wingtai: Has cleared the 2.00 psychological resistance as mentioned previously, new phase upwards possible to 2.10 first. At 2.03

Follow up from previous BUY CALL: http://singaporetradinginsights.blogspot.sg/2014/04/wingtai-follow-up-from-email-to-clients.html

WingtaI has indeed broke above target at 2.00. More upside can be possible on this breakout seen today to a target at 2.10 then 2.25. At this level, it has also broken above the 200 DAY long term MA line which is a positive in long term. Can continue to ride the uptrend while raising stop loss along the way.

Raise Stop loss to 1.985

********************** Swissco: Positive call triggered.............. LIVE SMS and EMAIL to clients previously ! NOW AT 0.45 !

Congrats to some clients who managed to get on to Swissco on time on Monday before its ascent.

This Blog highlights "ONLY" some of the calls that our Clients received and "ONLY" after OUR Clients have received it. Be our client now to RECEIVE “ALL” Technical Trading calls "LIVE", TOP Fundamental research in your INBOX now plus “LIVE SMS”, plus many more value added service. Don’t miss out ! Some have already locked in profits today……..

Email to enquiry@firstratebrokers.com NOW ! OR Click here to Open a Free Trading account ! J

Wednesday, April 23, 2014

************************* STI DIRECTION : Where is the market heading to now ??

Following up from previous STI Direction post: http://singaporetradinginsights.blogspot.sg/search/label/STI

STI has indeed neared the resistance at 3280 with a high at 3274 seen today….. It is likely to face key resistance around this level from 3280 downwards. May see the index in the range of 3250 to 3280 in the coming days before any further direction is make known. If STI index can really cross above the 3280 and finally 3300 as confirmation, we can start to see BUYERS coming in to take the index higher to as high as 3450. (Look at the gap that the market has created previously). If not we may also hit this KEY resistance levels and market can start to take profit and dip from here again where we can see support at 3230 then 3190.

Keep these levels in mind while trading………. J

****************** Osim: Still a BUY, Uptrend very much intact, ride the upside along the way...... Now at 2.78

Following up from Previous BUY CALL: http://singaporetradinginsights.blogspot.sg/2014/03/osim-uptrend-intact-buy-and-hold-for.html

Osim has indeed neared our target at 2.80, today we have seen it broke above the 2.75 resistance level which was holding for more than 2 weeks already. More upside can be possible if psychological 2.80 resistance gets cleared out too and its poised to head higher to 3.00. Have seen it formed higher lows since 2 months ago while consolidating upwards. Can accumulate on dips above 2.70 if possible now.

Raise Stop loss higher at 2.73 and continue to ride the uptrend.

***************** Suntec REIT: Potential upside to 2.00 on breakout above 1.75 ! Keep in view.

Suntec REIT has been consolidating below 1.75 resistance level since June last year forming a Bullish Double bottom with support at the 1.50 as of today. Can watch list this counter for more upside if the CRITICAL resistance at 1.75 breaks out, if that happens, we may see it trade higher to 2.00 eventually. Possible to accumulate before breakout also but would have to hold in wait for it (who knows when ?). Consistently supported above the 1.50 level which also coincides with the 200 DAY Long term MA which signals that long term uptrend still pretty much intact.

Stop loss at 1.72 on breakout.

OCBC - 20 March 2014

Suntec REIT: Cash call for strength and growth

Suntec REIT announced yesterday that it will be issuing 218.1m new units at S$1.605 apiece via a private placement. The move came as a surprise to us as Suntec REIT had explicitly expressed that it has sufficient resources to fund its growth plans just a quarter ago, and that it was trading at a 21% discount to book value. According to management, the current intention is to use the proceeds to repay its existing debt, which is likely to reduce its debt burden and aggregate leverage. However, given the change in stance, we believe that Suntec REIT may possibly be beefing up its financial strength for potential growth opportunities in the near term. We maintain BUY with a revised fair value of S$1.85 (S$1.90 previously) on Suntec REIT.

Suntec REIT announced yesterday that it will be issuing 218.1m new units at S$1.605 apiece via a private placement. The move came as a surprise to us as Suntec REIT had explicitly expressed that it has sufficient resources to fund its growth plans just a quarter ago, and that it was trading at a 21% discount to book value. According to management, the current intention is to use the proceeds to repay its existing debt, which is likely to reduce its debt burden and aggregate leverage. However, given the change in stance, we believe that Suntec REIT may possibly be beefing up its financial strength for potential growth opportunities in the near term. We maintain BUY with a revised fair value of S$1.85 (S$1.90 previously) on Suntec REIT.

REPOST to Blog********************* Mapletree GCC: Bullish Reverse Head and Shoulder spotted, can it stay above neckline resistance now ? At 0.87....... (REPOST - Emailed to clients previously, at 0.89 now)

AND ALSO Be Alerted through SMS - http://bit.ly/1jGyc0g

Tuesday, April 22, 2014

Hong Leong Asia: Strong Buy ups seen.... Short term upside may still continue..... ( REPOST TO BLOG )

LIVE Call emailed to Clients yesterday ! Now at 1..695, Look likely to break above 1.70 soon.

*********************** Q&M Dental: further breakout seen, slow and steady.... More upside in place..... at 0.46 !

Follow up from previous BUY CALL: http://singaporetradinginsights.blogspot.sg/2014/04/q-dental-uptrend-stock-more-upside-on.html

Q&M Dental has indeed consolidated for slightly more than a week before we have seen a further breakout above 0.45 again. Likely to head to 0.48 to 0.50 gradually on this break up. Channel support line still holds and uptrend remains intact, so far have seen breakup higher on each mini consolidation. Can continue to ride the uptrend and raise stop loss along the way.

Stop loss at 0.435 now, raised upwards from previous.

Monday, April 21, 2014

******************United Engineers: Further breakout from previous buy call........... Still strong !! (Follow UP from Previous call)

Follow up from previous buy call: http://singaporetradinginsights.blogspot.sg/2014/04/utd-engineers-follow-up-from-previous.html

United Engineer has indeed traded higher and touched target at 2.30… today we have seen it break the 2.30 further, likely to head to 2.50 in the near term. Can try to accumulate on dips from 2.32 to 2.35 with a temp resistance at 2.40 first.

Stop loss at 2.27.

************************** Kingwan: A potential breakout play....... May consolidate from 0.325 to 0.35 before further uptick......

Kingwan has been consolidating upwards for about 2 weeks since breaking above the 0.28 resistance level (Downward sloping channel resistance line). This can signal an end to its downward trend formed since May last year. Has seen it trading a week below the 0.325 immediate resistance and today we have seen it crossed above on TOP 20 Volume. Entry can be possible from 0.325 to 0.33. Wait for the break above 0.35 for a new high where we can see it push higher further on momentum. Target to 0.400 near term on this breakout then J

Stop loss at 0.295.

Thursday, April 17, 2014

****************** Ezion: SMS CALL to clients in THE MORNING LIVE ! .............. 2.29 now ! Did you catch it ?

Our clients were alerted quickly BY SMS to the BREAKOUT OF Ezion live this morning when it broke the 2.20 …. Congrats to some that manage to enter on time before its further uptick ! Join us !

REPOST TO BLOG - Ezion have broken up above the 2.15 level which is the channel resistance downward sloping line. This can signal a new upward trend from here on. Today we have also seen it break above the psychological 2.20 level which it has been consolidating below for more than a month….. More upside possible on this breakout, with target to 2.35 then 2.45. RSI indicator pointing upwards and Bullish stochastic crossover seen. Note that it has been trading above the 200 DAY MA long term trend line for more than 2 years and supported well there so uptrend in the long term still very much in place, of course with the temp dips occasionally.

Stop loss at 2.17.

Subscribe to:

Posts (Atom)