With the world gradually opening up and tourist starting to flock back into Singapore, what is the one stock that can ride the post Covid recovery strongly.

This company has recently reported an impressive set of results strong revenue and EBITDA recoveries at 107% and 143% y-o-y respectively.

It is the best quarter since Covid-19 with revenue and net profit recovering to about 87% and 85% of 3QFY2019's.

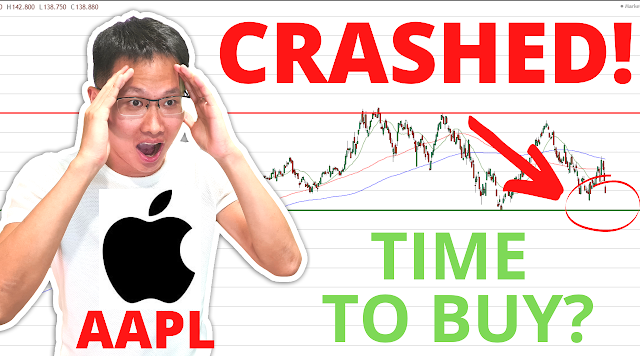

Technically, on the chart, we also saw some bullish price actions coming back last week where some upside targets were drawn.

It seems like it has pushed up a little but where are we now and what are the targets again,.

Watch this video to find out WHAT stock is this and WHY I like it for now as long as we stay above this key support that I will be talking about.

Discover here >> https://youtu.be/Ef7RBNgLSVk