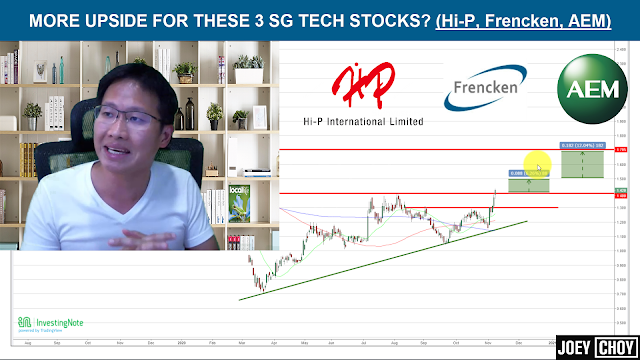

Over the past 2 months, we have 2 stocks that came into our watchlist where the 𝐮𝐩𝐭𝐫𝐞𝐧𝐝 𝐰𝐚𝐬 𝐬𝐭𝐚𝐫𝐭𝐢𝐧𝐠 𝐭𝐨 𝐭𝐚𝐤𝐞 𝐬𝐡𝐚𝐩𝐞.📈📈

They have kind of breached some of those key levels any buyers were ready to take them higher.

These 2 stocks are 𝐅𝐫𝐞𝐧𝐜𝐤𝐞𝐧 𝐚𝐧𝐝 𝐒𝐮𝐧𝐩𝐨𝐰𝐞𝐫.

We have pushed higher indeed but can there be more strength as we head into next year? 😄

Joey here, Top Tier Remisier in Phillip Securities.

Watch this video all the way to the end and discover how you can still position yourself in them.

With these key support levels holding, still good to go imo. 👍

I will also share about the 𝐛𝐮𝐥𝐥𝐢𝐬𝐡 𝐬𝐢𝐠𝐧𝐚𝐥𝐬 𝐭𝐡𝐚𝐭 𝐰𝐞 𝐡𝐚𝐯𝐞 𝐠𝐨𝐭𝐭𝐞𝐧 𝐨𝐧 𝐭𝐡𝐞𝐦 𝐨𝐧 𝐦𝐲 𝟏𝐆𝐓 𝐒𝐲𝐬𝐭𝐞𝐦, will be interesting to see where they can head to..

Watch here >> https://youtu.be/CIzODlLx0g0